Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Aporia

I wonder and admire

In discretionary trading, you’re handicapped by the lack of reliable testing and repeatable iteration. Because decisions are made case-by-case, you can’t generate the large sample of trades or the statistical confidence that a systematic process provides. That absence of rigorous testing means you can’t lean on iterations to refine or validate an idea; you must judge opportunities in real time with far less evidence.

That constraint forces discretionary traders to be extremely selective: there are far fewer trades to take, and any prospective edge has to jump out as obvious and convincing. If an edge isn’t blatantly clear to you in the moment, it won’t be repeatable under different market conditions, so you effectively do nothing most of the time, waiting for setups that feel unmistakably tilted in your favor.

By contrast, systematic trading builds confidence through structure: defined rules, backtests, and iterative improvement let you harvest many smaller, statistically defensible edges. Where a discretionary trader needs a glaringly obvious advantage to act, a systematic approach can accumulate lots of subtle advantages. This is not meant to judge either way; everyone has to find the approach that best fits their personality.

11,73K

damn

Aporia7.5.2025

last cycle around this time ETH topped vs. BTC

this time around it bottoms

(for the sake of my bags)

31,02K

People who succeed in trading usually do so by leaning on skills developed in other areas: General curiosity about games, systems, and mental frameworks, a strong sense of integrity, etc. Trading amplifies, exposes and teaches those interests and habits, but it rarely creates them from scratch.

For me, this is mainly about first-principles thinking. It’s stripping away assumptions, inherited narratives, and surface-level trends to ask: What’s irreducible here? Markets teach this ruthlessly: any unjustified complexity gets you rekt. They demand simplicity. But simplicity is not the avoidance of complexity. It’s the product of deliberate refinement.

By stripping away layers, you identify not just the actors, but the levers. Markets are a masterclass in this. But every domain (careers, art, politics, love, etc.) has its own “physics”. This abstraction leads to agency. When you understand the forces at play, you stop reacting to symptoms and start engaging with systems.

Similarly, life’s ambiguities become navigable when you’ve rigorously defined your own terms: what matters, what’s negotiable, and what’s foundational. Markets teach you to think in tensions and trade-offs; life rewards you for applying that same rigor. Yet, this lens works both ways: the same rigor that grants agency also exposes the fragility of your assumptions. It humbles as much as it empowers.

87,68K

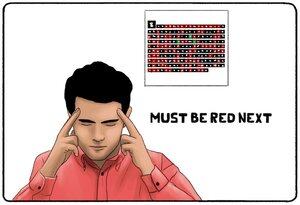

“I’ve been on the right side for a while, red is next”

(absolutely not gambler’s fallacy)

Wolf 🐺13.8. klo 01.50

I’ve been on the right side for a while, we spotted the broadening wedge early, and trust me when I tell you, there will be a brutal correction.

I’m saying this now so you don’t flatline when it hits.

It might even happen above $5.5ks.

9,61K

I find it surprising that the emotional side of psychology is talked about far more than the cognitive side. The usual advice is:

“Control your emotions.”

“You just need to manage your emotions.”

“The key is patience.”

“You are your biggest enemy.”

As if that’s the main barrier to success. But that focus often comes before even asking whether you have a trading strategy that actually works. Before worrying about emotional discipline, you should have a system you’ve built, tested, and proven; something you’ve backtested, validated out-of-sample to avoid overfitting, etc.

Without that, the “you’re just too emotional” narrative makes it seem like you are the problem, when the real issue might be that what you’re doing simply isn’t a viable system. The first question should be: Do you have a structured, profitable strategy at all? Only then does managing emotions make sense as the next step. It’s like stressing about tire pressure on a car with no engine.

15,97K

There’s a saying that floats around frequently on my feed: “You are only as good as your last trade.” I find it deeply misleading and, frankly, wrong. I don’t even understand what the point of it is supposed to be.

One trade is nothing more than a single data point in a large distribution. Randomness exerts such a large degree of influence on it that true skill barely registers in that moment. A single outcome cannot and will not reveal the quality of your strategy, your decision-making, your trade management, or any other variable worth measuring.

In reality, the opposite is true: only after a large body of trades do the real patterns emerge. That’s when you can see if your strategy holds up, if the numbers you expected are reliable, if it is truly profitable or not and whether your own management of those trades supported that outcome.

Only over a significant sample size do meaningful conclusions evolve out of the noise. Maybe I’ve misunderstood what it’s meant to convey, and I’m happy to stand corrected if someone can explain it, but to me, it simply makes no sense at all.

15,09K

Wherever I look, I see the same two traits in consistent winners. Their methods look different on the surface, but something common runs underneath.

1) They accept the game’s probabilistic nature and willingly submit to it. Randomness sways individual outcomes, but over a large enough sample its noise recedes and a well-built edge prevails. So they optimize for positive expected value, size positions to survive variance, and let the long run surface their skill.

2) They love the game enough that the pitfalls randomness creates don’t feel like pushing through; they feel like puzzles worth solving. That passion makes reviewing losses, iterating, and returning the next day feel natural, not forced. From the outside it looks like grit; from the inside it’s immersion that lasts long enough for the edge to compound.

Taken together: cold probabilistic discipline paired with genuine love for the game. The first keeps you making +EV choices and surviving the swings; the second keeps you engaged long enough for the edge to emerge.

55,01K

yes sir, you posted copper/gold ratio a gazillion times already without naming it, we understand

TechDev8.8. klo 14.01

Instead of trying to guess which news event is “cycle top” worthy, what if you just watched the cycle?

Because the one that’s always mattered is at the bottom.

866

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin