Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

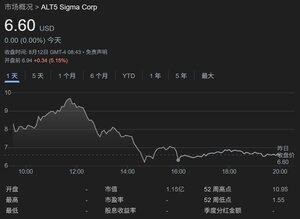

A vulgar understanding of ALTS stocks from Hovz

The valuation difference between WLFI tokens and ALTS stocks

▶️ Currently, the market cap of ALTS stocks corresponding to WLFI is about $17 billion, while in pre-market trading, the market cap of WLFI tokens has already been benchmarked at $35 to $45 billion. This significant valuation difference is one of the most important arbitrage opportunities in the market. Since WLFI tokens have not yet been listed, the market has not fully reflected their intrinsic value, providing a relatively low-priced investment opportunity for ALTS stocks.

▶️ WLFI currently holds a large amount of ALTS stocks, which is significantly similar to ETH's microstrategy. ETH's microstrategy stabilizes the market and drives up prices by holding a large amount of ETH tokens and controlling and managing supply. Similarly, WLFI, through its high control over ALTS stocks, effectively manages the supply and demand relationship in the market, playing a key role in price management and market cap enhancement.

▶️ Unlike traditional BTC/ETH microstrategies, WLFI has laid out in the stock market in advance, clearly creating a favorable market environment for its token listing. This strategy indicates that WLFI is not only driving market cap growth through dynamics in the crypto space but is also utilizing tools from the stock market to manage prices and market sentiment, thereby maximizing value.

▶️ WLFI has locked in a large amount of ALTS stocks in this way, and the price of ALTS is closely related to the market cap of WLFI. Once WLFI gradually raises the price of ALTS stocks in future market cap management processes, it will not only promote the appreciation of the stocks themselves but will also enhance market expectations for WLFI tokens, creating a positive feedback loop.

The investment path of foreign capital and Web2 giants: the bridging role of ALTS

▶️ WLFI's public offering is mainly dominated by funds from the crypto space, while foreign institutions and Web2 giants cannot directly purchase WLFI tokens. In this case, ALTS stocks become the only way for foreign capital to enter the WLFI ecosystem. The inflow of foreign capital is expected to be an important factor driving up the price of ALTS stocks.

▶️ Through ALTS stocks, foreign capital can participate in the WLFI ecosystem without having to wait for the official listing of WLFI tokens. For investors who are optimistic about WLFI's long-term growth, ALTS stocks provide a convenient entry point, further boosting the market demand for ALTS stocks.

The advantages of ALTS stocks as a low-cost investment channel

▶️ ALTS stocks offer a relatively low-cost way to participate in the WLFI ecosystem. Currently, the price of ALTS is low, especially compared to the high price of WLFI in pre-market trading. By purchasing ALTS stocks, investors can indirectly hold WLFI tokens in a more cost-effective manner.

▶️ As the stock delivery of WLFI's increased issuance is completed, market expectations for WLFI's market cap management operations will further enhance the attractiveness of ALTS stocks. Investors can position themselves in relatively undervalued ALTS stocks in advance and enjoy the returns brought by the future potential of the WLFI ecosystem.

Disclaimer: This analysis is for reference only and does not constitute financial advice.

20,48K

Johtavat

Rankkaus

Suosikit