Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

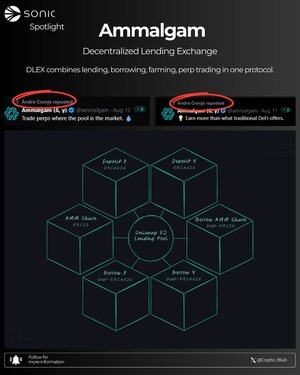

💡Project Spotlight @ammalgam

DLEX combines lending, borrowing, farming, perp trading in one protocol👇

Products:

🔹AMM based on Uni V2

🔹Lend/borrow (LP or native tokens)

🔹Swap

🔹Perp trading

Ammalgam’s DLEX uses seven modular contracts for functions like lending, borrowing, and liquidity provisioning, delivering AMM-style efficiency without oracles, avoiding price feed exploits, and maximizing capital efficiency.

Security/Risks:

🔹Oracle-free, fully decentralized

🔹Overcollateralized

🔹Isolated per AMM pair

🔹Risk engine for liquidations

DP Pools (Lending + LPing):

Dual Purpose Pools (DP Pools) combine AMM and lending, enabling liquidity providers to earn swap fees and lending interest from a single deposit.

Capital Efficiency:

Amalgam maximizes capital efficiency by integrating trading and lending within a unified AMM structure.

🔹Dynamic swap pricing

🔹Increased efficiency through leveraging

Perpetuals Engine:

The DLEX operates on a perpetuals-style engine, allowing directional exposure with margin. Positions are opened within Dual-Purpose Pools (DP Pools), providing native liquidity access without external matching engines or segregated order books.

All positions are:

🔹Isolated to individual AMM pairs (example WBTC/USDC)

🔹Overcollateralized with pool deposit assets

🔹Adjusted based on real-time pool state, oracles, and utilization rates

Recipe:

Choose strategies like lending, LPing, or leverage in one composable position:

🔹Long/short

🔹Market making

🔹Delta-neutral market making

🔹Long/short market making

🔹Straddle

🔹Calls

🔹Puts

Nice approach to combine everything in DeFi in one protocol.

Looks like Andre also likes Ammalgam, he is reposting everything.

Innovation is coming to $S my friends, this could be interesting for everyone, no matter if farmer, perp trader or spot buyer.

Farming Lp and lending against your yielding position - this remember me on old FTM times.

Curious to test some receipes and share it on X.

9,61K

Johtavat

Rankkaus

Suosikit